Trs pension calculator

Receipt of COLA is not automatic. Get started with a calculator below plus receive additional news and resources when you sign up for our newsletter.

Mabent33 Posted To Instagram Teacher Retirement System Of Texas Trs Trs Texas Gov Trs Teachersofinstagram Texastea Teacher Retirement Teacher Teachers

Tier 1 members in Teachers Retirement System of the State of Illinois first contributed to TRS before Jan.

. Pension Factor Tiers 1 and 2. Early retirement Calculator Excel106KB. New TRS Podcast Episode.

You may use this calculator far in advance of your retirement to help you develop your personal retirement strategy by experimenting with various retirement scenarios. The early retirement calculator shows what to expect if you claim benefits earlier than normal pension age. At Canada Life we also manage legacy solutions previously sold by ManuLife and Albany Life which offered access to smaller ranges of life and pension funds as well as With-Profits funds.

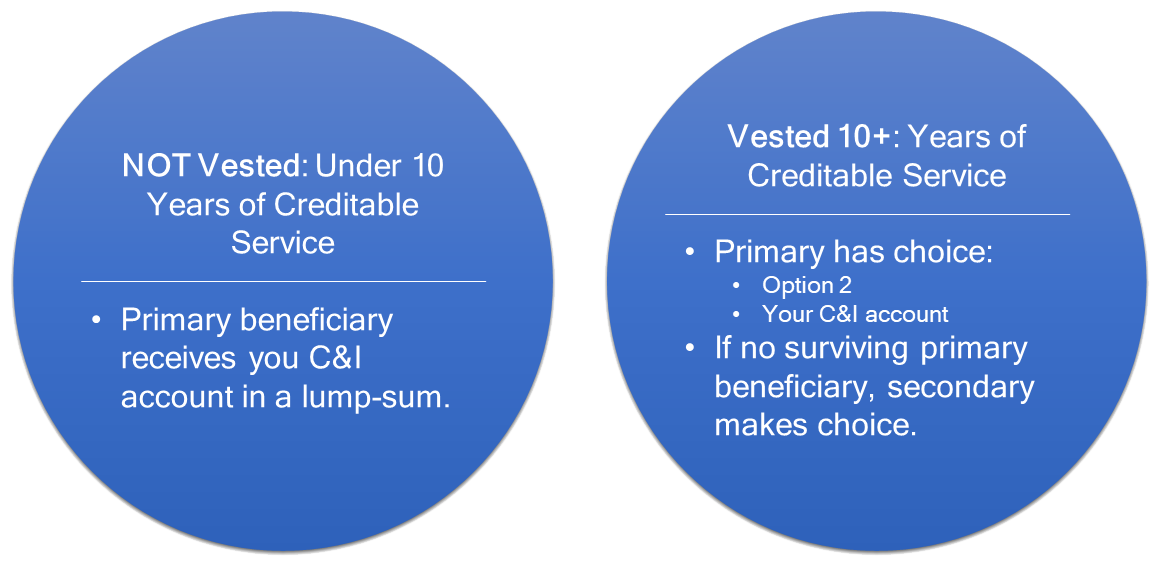

Of the 20 years only 40 months were not covered by SS. Under the Option F annuity for life with return of purchase price however a 60-year old investor needs to invest Rs 10526315 to get a monthly pension of Rs 51974. Have you updated your beneficiaries.

The welcome to the rapists and murderers after they were released from jail by some people who follow a certain ideology is a slap on the face of a just society TRS MLC Kavitha said referring to the reception the 11 convicts in the case relating to Bilkis Bano gang rape and murder of her kin during the 2002 riots received. I have a TRS pension based on 20 years of being a TX teacher. This can be found on your TRS ABS 2015 Scheme in the table under the standard benefits heading.

Members who first entered the TRS after June 30 1990 but before July 1 2006 and their survivors if they are at least age 65. 1 2011 or have pre-existing creditable service with a reciprocal pension system prior to Jan. You might want to speak with your tax advisor or the IRS if you have questions about your tax withholding.

Private School Service Credit If you previously worked in a recognized private school you may be eligible to purchase up to 2 years of service credit. Since 1917 TRS has been building better tomorrows for New York City educators. TRS is one of the largest pension systems in the United States serving 200000 members.

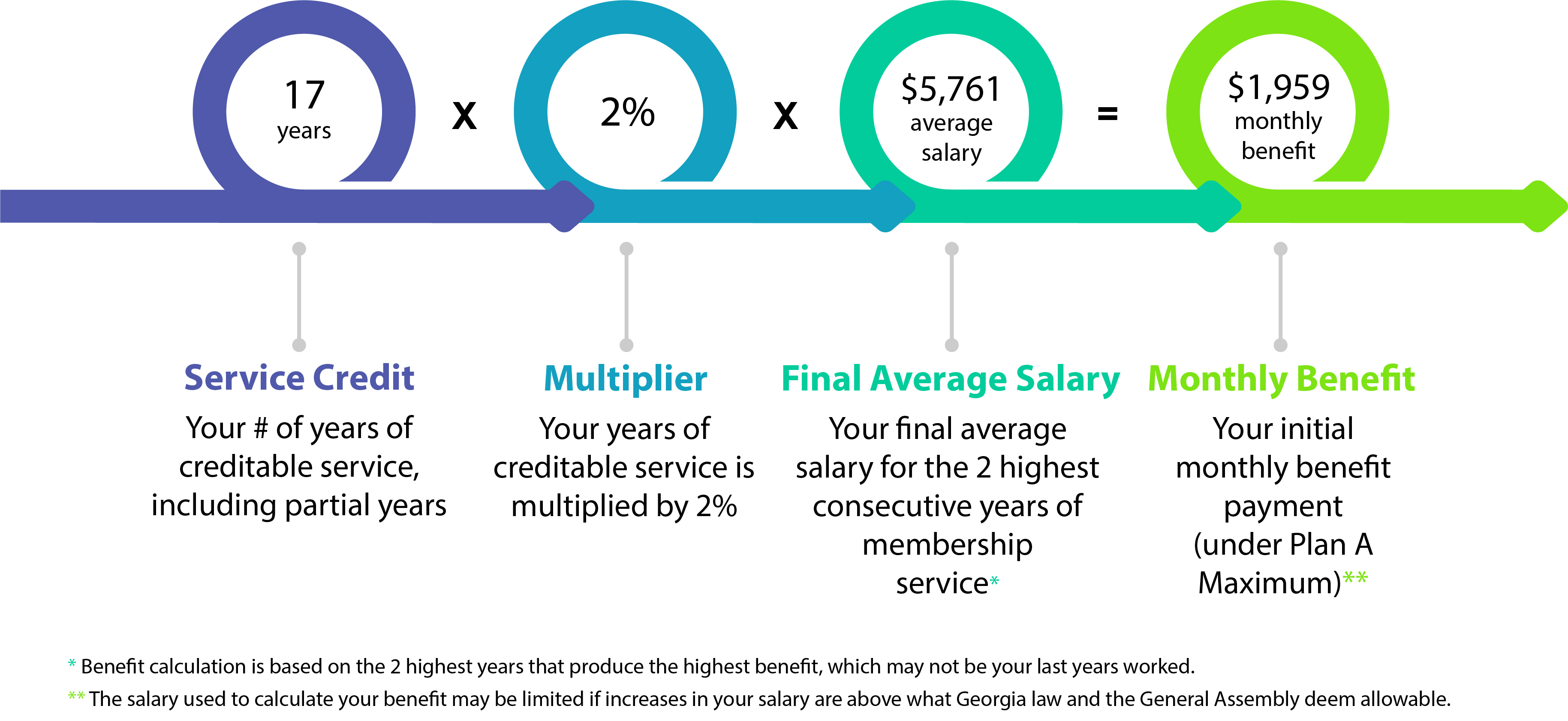

This pension calculator is provided solely as a tool for an individual member to obtain an unofficial estimate of their retirement benefits. Use the NHS Pension Scheme Annual Allowance Tax Ready Reckoner to assess your annual allowance liability for 202223. The calculator uses your salary and service credit information to create an estimate.

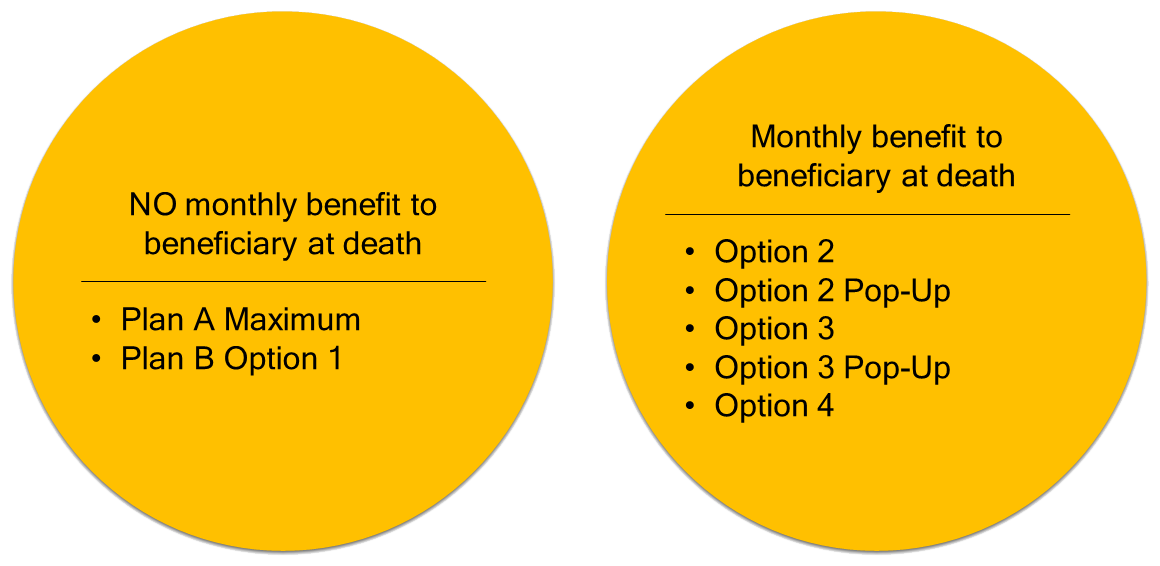

You can fine-tune your estimate by entering different retirement dates beneficiaries earnings and service credit amounts to see how they affect your potential benefit. In a series of tweets in Hindi Kavitha said. TRS Defined Contribution Retirement Plan Features and Highlights Employer Toolkit TRS ElectionWaiver of Supplemental Contributions trs019 TRS Employer Manual.

TRS offers members a Tax-Deferred Annuity Program to supplement their benefits under the Qualified Pension Plan. A 18 per year of credit for NYS service before 1959 and b 2 per year for NYS service after 1959 and c if eligible 1 per year for prior out-of-state service as long as this. This calculator will tell you.

This program designed just for TRS retirees reviews timely topics such as beneficiary designations Required Minimum Distributions and online access to TRS accounts. Nearing retirementThere is an IRS withholding calculator available through your online account. Account access at your fingertips - view information about your MassMutual insurance annuities pension annuities and investment accounts - view bills schedule payments update your address download 1099s and more.

To estimate the cost use the Buy Back Calculator for Public Education Experience. Youll need to access your Annual Benefit Statement to use the calculator. Your pension factor equals the sum of.

Were carrying out some essential maintenance. If you do not have an online account DRS has another withholding calculator available to you. Are you collecting your pension and planning to work after retirement.

From 7pm Friday 9th to 6pm Sunday 11th September you wont be able to access our online systems for Annuities The Retirement Account Onshore and Offshore Bonds CLASS or Individual Protection. Flexible Income Annuity Old pension series - Retirement Advantage FIA CanRetire Flexible Drawdown Plan CanRetire Pension Investment Plan. TRS Plan 2 is a lifetime retirement pension plan available to public employees in Washington.

My TRS Log In. Log in to your TRS Account today. Most members can estimate their pension using the benefit calculator in Retirement Online.

The programs we offer are listed below. Annual allowance tax charge calculator. Advance Planning for Retirees.

Investment Joint Management Committee Meetings August. Members who first entered the TRS before July 1 1990 and their survivors. All disabled members receiving PERS or TRS disability benefits regardless of age or date of hire.

The State University of New York provides employees with the opportunity to save for their retirement through the SUNY 403b Plan and the NYS Deferred Compensation Plan. This calculator uses only information provided by you and does not use any information contained in the records of the Retirement System. The calculator will not estimate 1995 Section benefits for members aged 50 to 55.

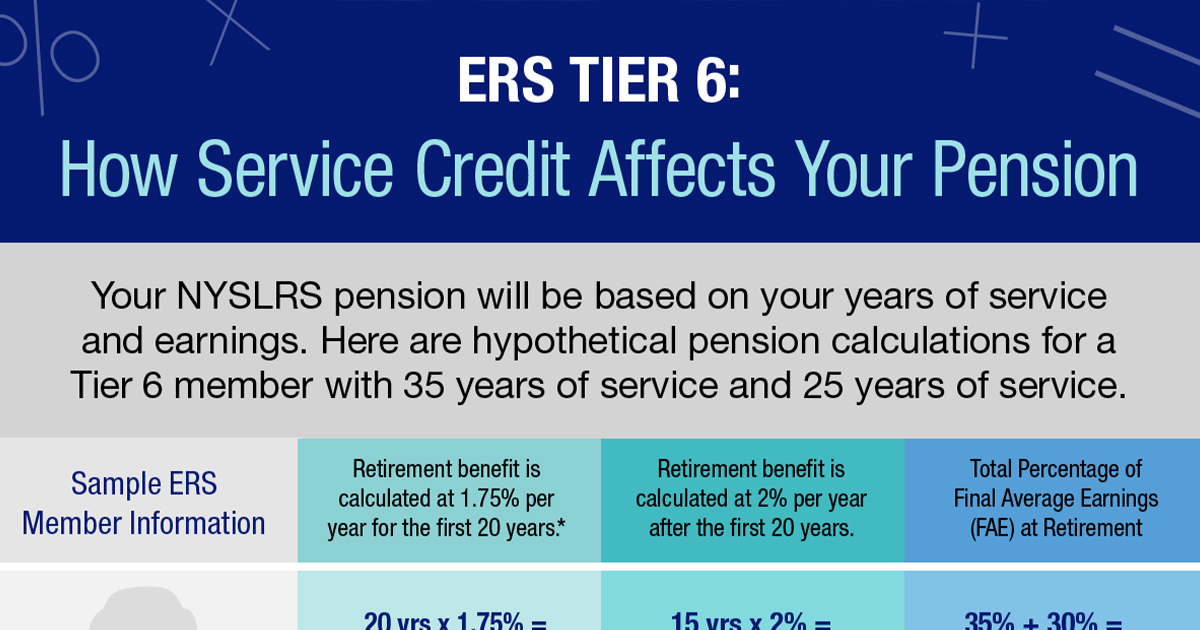

This statement and calculations of your estimated retirement benefit are based on unverified data and are only approximations of the amount you would receive upon retiring. You and your employer contribute a percentage of income to fund the plan. Pension Factor x Age Factor if applicable x Final Average Salary Maximum Annual Pension.

The amount of Social Security benefit you can expect after the WEP reduction for comparison we also illustrate your benefit without considering the WEP. Participating in a voluntary savings plan is a great way to build your retirement savings and allows for retirement savings on a pre- and post-tax basis. House Bill HB 385 HB 385 Explained for Retirees Employers.

TRS Former Member Election of Participation DB or DCR Plan trs037 TRS Guidelines to Apply for Retirement brochure trs027 TRS Leaving State Employment brochure trs012. The TRS pension calculator is an educational tool designed to help members who are more than 5 years from retirement estimate their monthly benefit for service retirement.

Teacher Retirement Retirement Retirement Cakes Retirement Cake Sayings Teacher Retirement

Teacher Retirement System Of Texas Facebook

Supplement Your Retirement Arizona State Retirement System

2

Ny Teacher Pension Calculations Made Simple The Legend Group

Ny Teacher Pension Calculations Made Simple The Legend Group

Ers Tier 6 Benefits A Closer Look New York Retirement News

Teachers Retirement System Of Georgia Trsga

How Do You Calculate A Teacher Pension Teacherpensions Org

Ny Teacher Pension Calculations Made Simple The Legend Group

Teachers Retirement System Of Georgia Trsga

Program Explainer Government Pension Offset

Welcome To Mytrs

Trs Contributions And Benefit Formula Quick Explanation Youtube

Teacher Retirement Retirement Teacher Cakes Retirement Cakes School Cake

Teachers Retirement System Of Georgia Trsga

Are Texas Teacher Retirement Benefits Adequate Bellwether Education Partners